Hong Kong tax on a territorial basis.

Hong Kong is one of the few countries in the world that tax on a territorial basis.

Many other countries levy tax on a different basis and they tax the world-wide profits of a business, including profits derived from an offshore source.

But Hong Kong profits tax is ONLY charged on profits derived from a trade, profession or business carried on in Hong Kong.

Consequently, this means that a company which carries on a business in Hong Kong, but derives profits from another place, is not required to pay tax in Hong Kong on those profits.

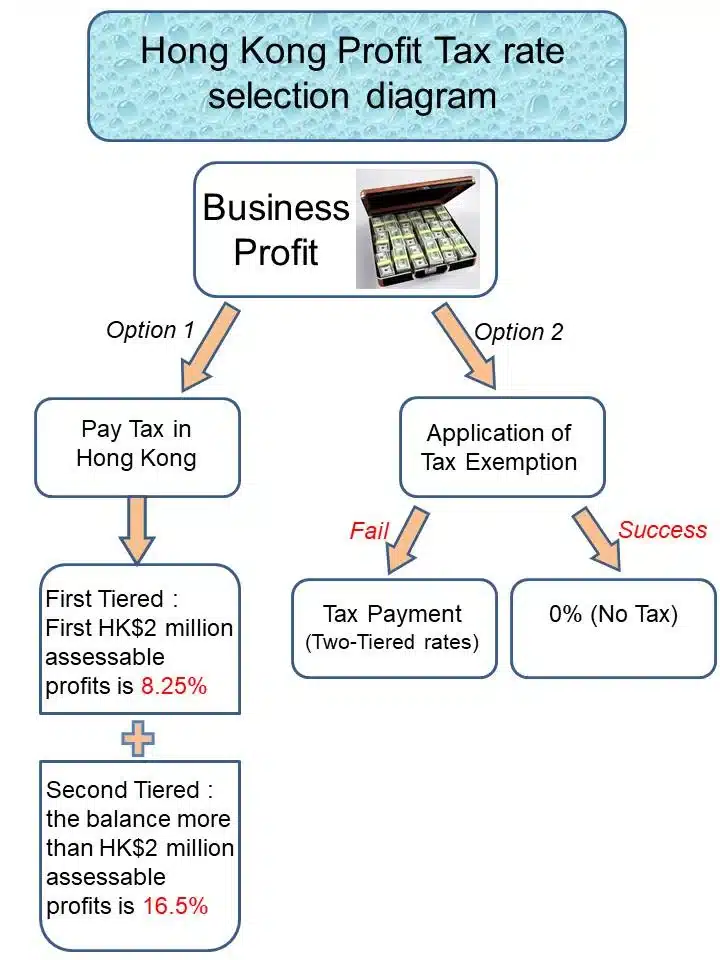

Hong Kong sourced income is currently subject to a rate of taxation of 8.75% of the first HK$2 million profits and 16.5% of the profits more than HKD2 million.

There is no tax in Hong Kong on capital gains, dividends and interest earned.

The principle of Hong Kong income tax

The principle of Hong Kong income tax is that it is a tax on income that has its source in Hong Kong rather than a tax based on residence.

Income sourced elsewhere, even remitted to Hong Kong, is not subject to Hong Kong profits tax at all.

Consequently, if a Hong Kong company’s trading or business activities are based outside Hong Kong, say in Europe, no taxation will be levied.

This makes Hong Kong an extremely cost- effective tax planning vehicle for trading.

The factor that determines the locality of profits from trading in goods and commodities is generally the place where the contracts for purchase and sale are effected. “Effected” does not only mean that the contracts are legally executed. It also covers the negotiation, conclusion and execution of the terms of the contracts.

If a business earns commission by securing buyers for products or by securing suppliers of products required by customers, the activity which gives rise to the commission income is the arrangement of the business to be transacted between the principals.

The source of the income is the place where the activities of the commission agent are performed.

If such activities are performed through an office in Hong Kong, the income has a source in Hong Kong.

However, there may be a corporate tax liability in the country where you ‘establish a place of business’ and control the company.

IRD Inland Revenue Department

A Simple Guide on The Territorial Source Principle of Taxation

Hong Kong adopts a territorial source principle of taxation. Only profits which have a source in Hong Kong are taxable here.

Profits sourced elsewhere are not subject to Hong Kong Profits Tax. The principle itself is very clear but its application in particular cases can be, at times, contentious. To clarify the operation of the principle, we have prepared this simple guide on the territorial source principle of taxation. It gives a brief explanation of how the principle operates and provides simple examples for illustrative purposes of the tests applied to different types of businesses.

If you wish to explore the subject in greater depth, we recommend that you consult your professional advisers.